Purchasing U.S. savings bonds can be one of the safest ways to earn money on your savings, as a savings bond’s value is backed by the full faith and credit of the U.S. government. They can also offer tax advantages over similar products, such as a savings account or certificate of deposit (CD).

- Us Savings Bond Calculator Download

- Savings Bond Calculator For Mac Free Online

- Us Savings Bond Calculator

- Savings Bond Calculator Download

Although you might not earn a lot of interest, the guaranteed return can make them an important part of some people’s portfolios. Learn more about how savings bonds work, how to calculate their value, and how to redeem.

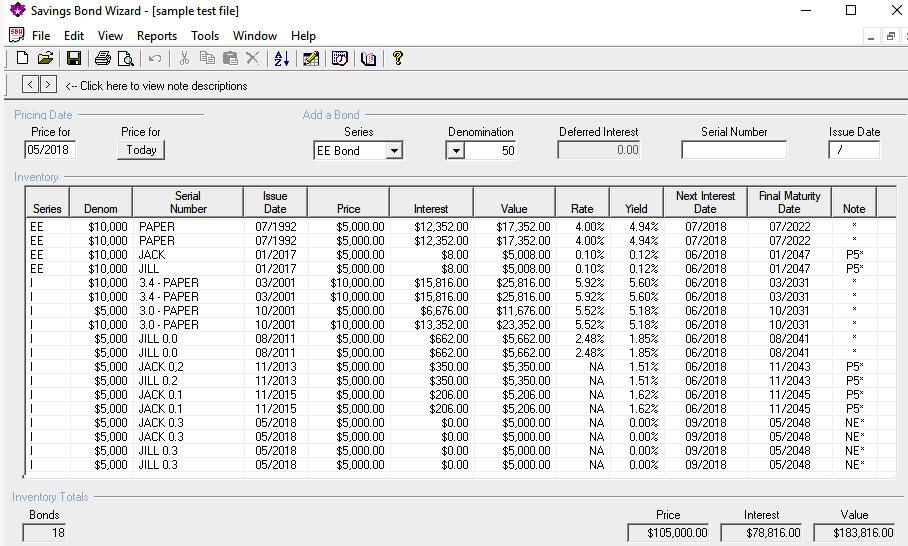

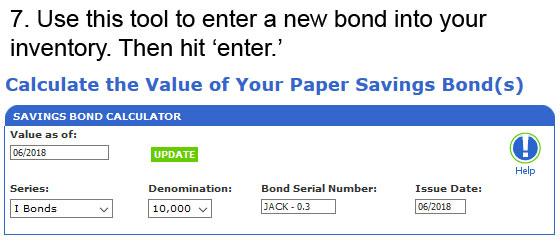

Use these calculators to find the yield that's equivalent to a tax-exempt investment. Vanguard Taxable-Equivalent Yield Calculator; Boglehead tfb's Bond Fund Yield Calculator, (the full article with instructions) You can also use this calculator to compare against a bank savings account, which is a federal and state taxable fund. Set your retirement goals and determine how much savings you need with this accessible retirement financial planner template. Enter your age, salary, savings, and investment return information, as well as desired retirement age and income, and the retirement planning template will calculate and chart the required earnings and savings each year to achieve your goals. Savings Bond Wizard v.4.15. This application will help you manage your savings bond inventory on your PC.The Savings Bond Wizard is an application that will help you manage your savings bond inventory on your PC.It's a downloadable program that allows you to maintain an inventory of your bonds and determine the current redemption value, earned. The Savings Bond Calculator WILL: Calculate the value of a paper bond based on the series, denomination, and issue date entered. (To calculate a value, you don't need to enter a serial number. However, if you plan to save an inventory of bonds, you may want to enter serial numbers.) Store savings bond information you enter so you can view or update it later.

How Savings Bonds Work

When you buy U.S. savings bonds, you’re lending the government money, and it will pay you back with interest. How much interest you’ll earn depends on the type of bond you have and how long you’ve held onto it.

Today, you can buy two types of U.S. savings bonds—Series EE and Series I.

- Series EE savings bonds have a fixed interest rate (Series EE bonds issued before May 2005 may have a variable rate). Starting with a $25 bond, you can buy up to $10,000 per year online at TreasuryDirect.gov. Interest gets added to the bond monthly, and the government guarantees that the bond will double in value after 20 years. After 30 years, EE savings bonds mature and stop accruing interest.

- Series I savings bonds have a fixed interest rate plus a variable rate based on inflation, which can change every six months. Although deflation could lead to a negative variable rate, the lowest your bond’s rate will go is 0%. You can buy Series I savings bonds online starting at $25 or purchase paper bonds starting at $50 with your federal tax return, up to $10,000 and $5,000 per year, respectively. The government doesn’t guarantee earnings, but interest can accrue for up to 30 years.

While these are the only types of savings bonds you can buy today, there are other types that you may have bought or been given in the past. You can use a savings bond calculator to find out how much they’re worth and determine if you want to redeem them now or wait.

Figuring Out How Much Your Savings Bond Is Worth

Savings bonds don’t provide a steady flow of income like a dividend-paying stock. Instead, accrued interest is added to the savings bond’s value, which you’ll receive when you redeem the bond.

With both Series EE and Series I bonds, the interest accrues monthly and compounds twice a year. You can use a calculator — like this savings bond calculator provided by TreasuryDirect — to determine the value of your savings bonds. You’ll need some information to get started:

- Series type

- Denomination

- Bond serial number

- Issue date

You must hold onto Series EE and I bonds for at least 12 months before you can cash out. Additionally, if you cash out one of the bonds before five years, you’ll lose three months’ worth of interest as a penalty.

Additionally, if you have Series EE bonds, don’t forget about the guaranteed doubling of value after 20 years. Although the interest rate may be low — it’s only 0.10% for bonds issued from May to October 2020 — you’ll still earn an effective rate of 3.5% if you hold the bonds for 20 years.

How to Cash in a Savings Bond

Us Savings Bond Calculator Download

You can cash in electronic bonds online at TreasuryDirect.gov. Or, if you have paper bonds, you can cash in at a local financial institution, such as a bank or credit union.

Savings bonds don’t expire, but Series EE and I bonds mature after 30 years, which means bonds issued before 1990 won’t accrue any more interest and there’s little reason to hold onto them. Sometimes, this may happen without you realizing it, such as if someone gave you a bond when you were a child.

As of the end of 2019, more than $26 billion dollars worth of unredeemed savings bonds had matured and stopped earning interest. You can use Treasury Hunt to search for bonds based on your tax identification number and state of residence.

When you cash in a bond, you’ll be issued a 1099-INT with a record of earned interest. Although you don’t have to pay local or state taxes on the earnings, you may need to pay federal income taxes.

You may also want to cash in a bond even if it hasn’t matured yet if you have a good use for the money. For example, eligible bondholders can avoid paying federal income taxes if they cash in and use the funds for qualified higher education expenses.

Or, you may want to cash in bonds if you need the money for living expenses during retirement or if you have a better investment opportunity elsewhere.

Bottom line: If you don’t need the money now and the interest is still being added, you might want to stow savings bonds in your safe deposit box until they fully mature. But if those bonds you got from as birthday gifts from your well-meaning extended family have matured, cash in and move those earnings to a higher interest investment.

Take control of your finances with Quicken.

Try Quicken for 30 days risk-free!

Max Heart Rate Calculator

You chose the *Basic version of the Max Heart Rate Calculator.

Create a free account to access the embed code for the Basic version of this calculator!

Select additional packages to add to your calculator.

back

Get this calculator for your site:

or

Max Heart Rate Formula:

Max Heart Rate = 220 - ageMax Heart Rate Definition

When determining your heart rate limits, you will want to use the max heart rate calculator to get an acceptable estimate of the rates that are right for your age. There are some important things to consider aside from age that can affect maximum heart rates, however. For example, consider the following:

How to Use the Max Heart Rate Calculator

To use this FREE online calculator, simply put your age into the Max Heart Rate Health Calculator and find out your max heart rate instantly!

Max Heart Rate Advice

Exercising, stress and many other events can raise your heart rate significantly. Learning your maximum heart rate using a Max Heart Rate Calculator can help you exercise safely, without damaging your heart. Age is the number one factor in determining your maximum heart rate per minute, but your overall health is also important to consider.

- You cannot damage your heart through exercise unless you have a condition that already affects the heart. For example, a history of heart attack may lower the acceptable heart rate for you personally. Athletes and those that are very physically active may be able to push their heart rate higher than their age suggests, on the other hand.

- If you live a very sedentary lifestyle, your heart rate limits will be much lower than your age would suggest. Those who are just beginning to exercise after being sedentary for a long period of time will need to allow their heart rate to increase in smaller increments over time than those already living an active lifestyle.

- Typically, a healthy adult cannot exceed their max heart rate. You will usually only be able to exert the amount of energy that your body is capable of, which in turn limits your heart rate to the number that you are able to achieve. Pushing yourself beyond capable limits is a difficult task to accomplish.

Savings Bond Calculator For Mac Free Online

Of course, using a Max Heart Rate Calculator is a good idea if you are just now beginning a workout plan and want to use a heart rate monitor during your routine. Checking your heart rate often and sticking to the number suggested by your doctor can also be very important if you have experienced heart trouble in the past, however. Some conditions that can affect your max heart rate include:

- Previous history of heart attack, stroke, or other heart related illness.

- Pregnant women may want to ask their doctor about max heart rates if they exercise on a regular basis.

- If you begin to feel breathless during exercise, you should slow down regardless of age or suggested maximum heart rate.

Max Heart Rate Exercise Tips

Exercising based on a max heart rate calculators suggestions can be a great way to enhance your heart health. If you begin to feel out of breath, resting for a few moments can be a good way to allow your body to catch up and remove the waste that accumulates in the bloodstream as a result of exercising. Some suggestions to improve heart health include these three simple ideas.

1. If you are living a sedentary lifestyle and want to get into shape, talk to your doctor about what kind of exercise would be ideal for you. Most doctors will suggest a brisk walk for thirty minutes a day and elevating your heart rate for at least a few moments of the walk to increase heart health.

2. Aerobic exercise happens anytime your heart rate increases, and is one of the best types of exercise for heart health. Aerobic exercise can be any type of movement that increases the heart rate, whether you are energetically vacuuming the rug or going for a jog.

Us Savings Bond Calculator

3. Sticking to your max heart rate suggestions will allow you to build heart health safely. If you are worried about heart rate when exercising, speaking to your physician can help you alleviate your fears and concerns.

You may also want to check out Target Heart Rate calculator

How to Calculate Max Heart Rate

Savings Bond Calculator Download

Let's be honest - sometimes the best max heart rate calculator is the one that is easy to use and doesn't require us to even know what the max heart rate formula is in the first place! But if you want to know the exact formula for calculating max heart rate then please check out the 'Formula' box above.

Add a Free Max Heart Rate Calculator Widget to Your Site!

You can get a free online max heart rate calculator for your website and you don't even have to download the max heart rate calculator - you can just copy and paste! The max heart rate calculator exactly as you see it above is 100% free for you to use. If you want to customize the colors, size, and more to better fit your site, then pricing starts at just $29.99 for a one time purchase. Click the 'Customize' button above to learn more!